2025 Tax Highlights

2026 Tax Filing Information for 2025 returns

Prepared January 6, 2025

One Big Beautiful Tax Bill Act (OBBBA) changes

There are a lot of changes this year, and I will go into a bit more detail below, but here is a quick list of new rules that will benefit most taxpayers:

100% bonus depreciation restored

Additional standard deduction for seniors

Deduction for tip income

Deduction for overtime income

Deduction for auto loan interest

Limit on Itemized deduction for taxes increased

Important 2026 dates

Today: When we can begin gathering information to file as soon as possible

January 26: E-file season opens*

February 2: Payroll reports, W2s, 1099s due

March 16: Partnership and S Corp returns due

April 15: Individual and corporate returns due

May 15: Calendar year non-profit returns due, Franchise Tax Returns

September 15: Extended partnership and S Corp returns due

October 15: Extended individual and corporate returns due

November 15: Extended non-profit returns due

*Note that for all but the simplest returns, it takes at least a week or two for all forms to be ready to Efile. It will be interesting to see how the many changes impact filing this year.

Ö Monday, March 16: The date we must have your complete information to guarantee we can file your individual return by April 15. Otherwise, we will try to file by the deadline but may have to file an extension.

New! Standard Deduction for senors (OBBBA)

An additional $6,000 deduction is available for each individual who is over 65. This deduction phases out when modified adjusted gross income (MAGI – which is generally total income plus exempt interest and the untaxed portion of social security) exceeds $75,000 for single filers and $150,000 for joint filers.

New! Deduction for tip income (OBBBA)

You can deduct up to $25,000 of the income you received in tips if you work in a job that “customarily and regularly” gets tip pay. This deduction phases out when MAGI hits $150,000 for single filers and $300,000 for joint filers. This year, you are responsible for computing your tip income.

New! Deduction for overtime income (OBBBA)

You can deduct up to $25,000 for the premium portion of your overtime pay ($12,500 for single filers) This is not for total overtime pay, but the premium amount added to your regular pay rate. So, if you are paid time-and-a-half for overtime, divide your total overtime pay by 3 to get the premium deduction amount. This deduction phases out at the $150,000 (single) and $300,000 (joint) MAGI amounts. Get this information from your last pay stub(s) of the year.

New! Deduction for auto loan interest (OBBBA)

You can deduct up to $10,000 for interest paid for a new vehicle purchased after December 31, 2024. This deduction phases out at the $100,000 (single) and $200,000 (joint) MAGA amounts. The other requirements are:

Not used or leased

For personal use only

Final assembly must be in the US – check with your dealer

Under 14,000 lbs gross vehicle weight

New! Deduction cap for state and local taxes (SALT) increased to $40,000 (OBBBA)

You can deduct up to $40,000 ($20,000 if married filing separate) for property taxes plus either sales or state income taxes. The old limit was $10,000. This mainly benefits people in states with high state income taxes and those with big property tax bills. You must itemize deductions to claim the SALT deduction and we take either the itemized or standard deduction, whichever is higher. This deduction phases out when MAGI hits $500,000.

Energy credits

See our charts for details about saving taxes with energy-efficient purchases you made last year.

Electric vehicle energy credits expired September 30, 2025 and home energy credits expired December 31, 2025.

Bonus depreciation (OBBBA)

Ö 100% Bonus depreciation for assets with a life of 20 years or less placed in service after January 19, 2025.

Brackets and charts

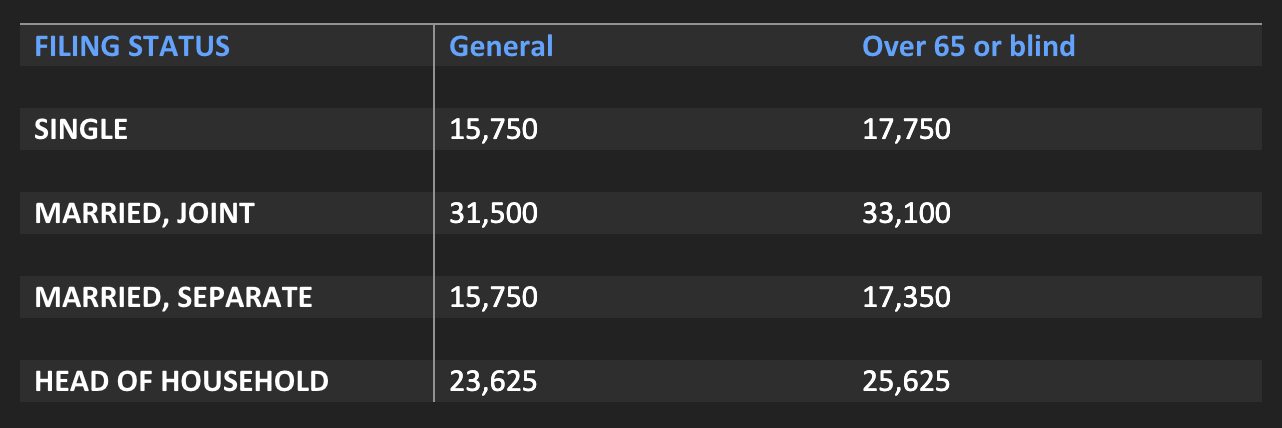

We can either take itemized deductions (limited medical, limited taxes, mortgage interest, charitable deductions) or the standard deduction, whichever is higher. Use this chart to see if it is worth the hassle of adding up your itemized deductions.

2025 standard deduction

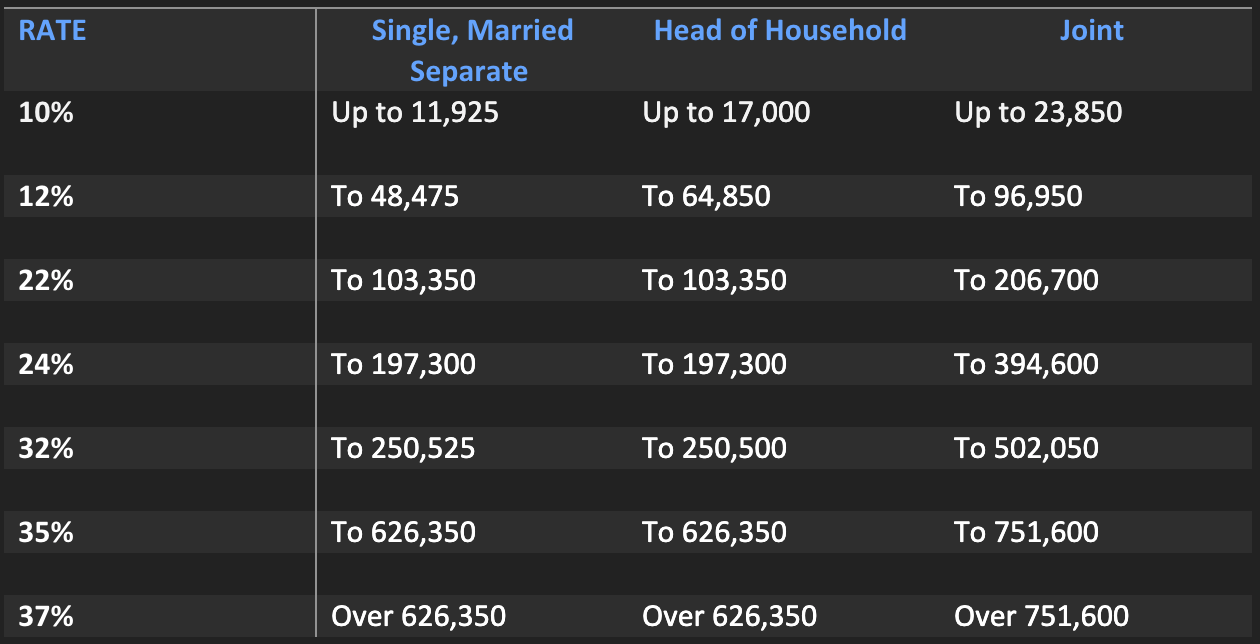

2025 tax brackets based on taxable income

Your tax is based on cumulative layers at the various rates up to your total taxable income. You can use this chart to find your marginal tax rate – the rate of tax you pay on the last dollar earned. This helps show the value of tax savings for deductible expenses. Still, never spend a dollar to save 30 cents.

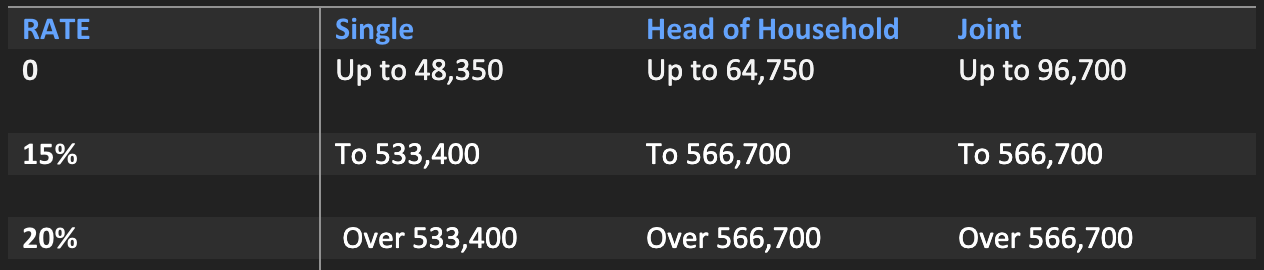

2025 long-term capital gains and qualified dividends tax rates

Important! Assets must be held for at least a year to qualify for long-term rates.

Remember the 3.8% investment income surtax gets added on for most filers paying capital gains tax.

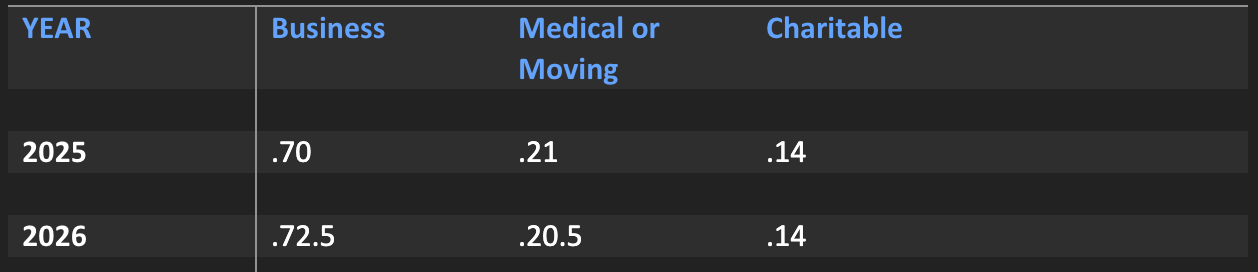

2025 & 2026 mileage rates

Note: Whether actual expenses or mileage is deducted, total and business miles must be reported.

Various limits & reminders

Required minimum distributions (RMD) must be taken by April 1, 2026 for the 2025 year if you turned 73 in 2024. The harsh penalty is 25%. See your financial advisor.

Important tip: If you are age 70 ½ you can pay up to $108,000 in charitable contributions directly from your IRA. This qualified charitable distribution counts toward your RMD and is not taxable income. (You do not get to also claim an itemized deduction for the contribution.) Talk to your investment adviser. Report these amounts clearly to us – they do not show up on the form 1099-R.

You can find a lot of information and check on your refund by setting up an online account with the IRS. https://www.irs.gov/payments/your-online-account

Paying into some retirement accounts is the main tax planning tool available after the cows get out of the barn (2025 is history). Funding for a prior year deduction can happen until the April deadline.

Contribution limit for traditional and Roth IRAs is $7,000; $8,000 if you are 50. Deductibility depends on whether you are covered by a retirement plan at work and income ceilings. Phase out MAGI ranges begin at $165,000 for single and head of household filers and at $236,000 for joint filers.

Contribution limit for Health savings accounts (HSA) is $4,300 for individuals and $8,550 for families. Those over 55 can add $1,000.

Contributions to a SEP-IRA are limited to the lesser of 25% of compensation or $70,000 (which is $350,000 in compensation).

You have until the date of filing your return or April 15, 2026 to make qualified IRA contributions for 2025.

Social Security wage base is $176,100 for 2025; $184,500 for 2026.

The annual gift exclusion is $19,000 for 2025.

Gifts over this amount to one person will require a gift tax return to be filed which, in most cases, reports use of the $13.99 million exemption without any tax being due by the giver or recipient. (Note: Married couples can give $38,000 in a split-interest gift to one person.)

Remember available education tax savings for you and your dependents:

American Opportunity Tax Credit up to $2,500

Lifetime Learning Credit up to $2,000

Deduction for student loan interest up to $2,500

These credits are limited as adjusted gross income increases.

Remember to check on energy tax credits for your home improvements.

Remember to include form 1095-A if you had health insurance through the marketplace. We can’t successfully e-file the return without it.

Housekeeping

Along with your tax documents and organizer, if you like to use one, we will need the following forms at check-in:

Personal info

Required engagement letter

Required forms for claiming certain credits like the child or dependent credit.

Form 1095-A, if applicable

Fees

Tax preparation fees are based on the time required and the complexity of the return. You can find starting point pricing on our website at https://www.mcneelyandmcneely.com/tax-services. We are adjusting some of our pricing to reflect typical charges for a firm with our history and experience.

Sharing Information

We prefer to share information securely and confidentially through your individual client portal. You will receive an e-mail invite, then you can download and upload files. We will, however, use mail, Fedex- whatever it takes within reason.

Procrastination target reminder

We may have to file an extension if we do not have your complete information by Monday, March 16, 2024.